Validated. Automated. Profitable.

Precision-engineered algo system with 8 entry triggers, walk-forward validation, and institutional risk controls—built for traders who trade data, not hope.

Start Your 7-Day Free Trial

Precision-engineered algo system with 8 entry triggers, walk-forward validation, and institutional risk controls—built for traders who trade data, not hope.

Start Your 7-Day Free Trial

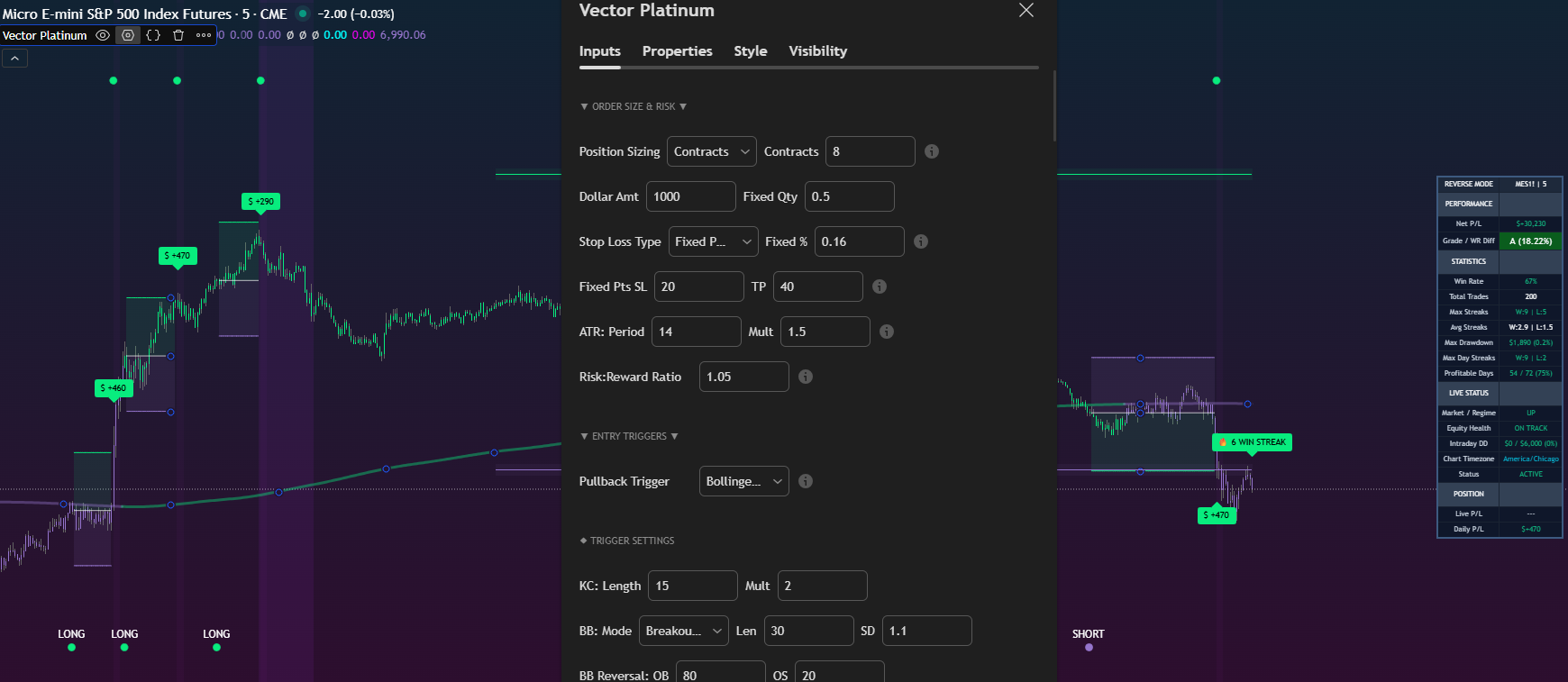

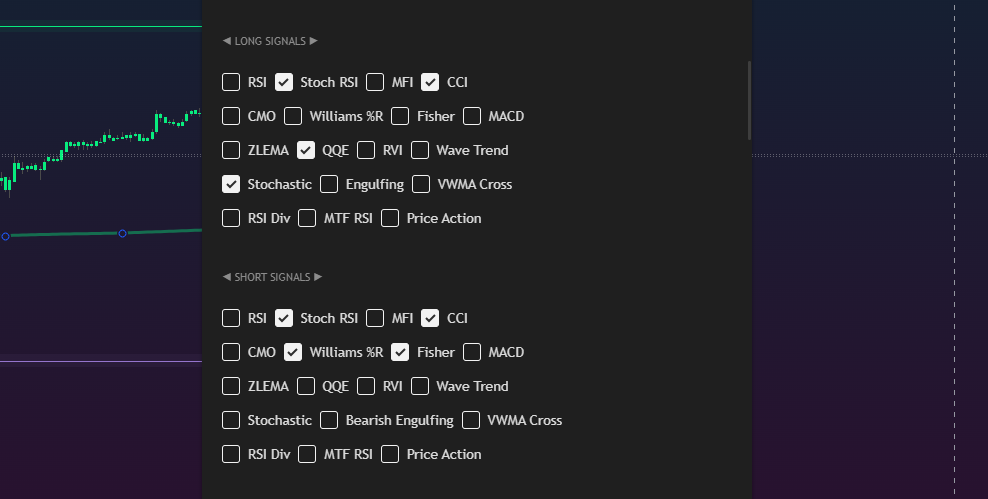

Vector Platinum is a professional algorithmic trading strategy built for TradingView that combines 8 entry triggers, 18 confluence filters, and Walk Forward Analysis to deliver validated, statistically robust trading signals across futures, forex, crypto, and stocks.

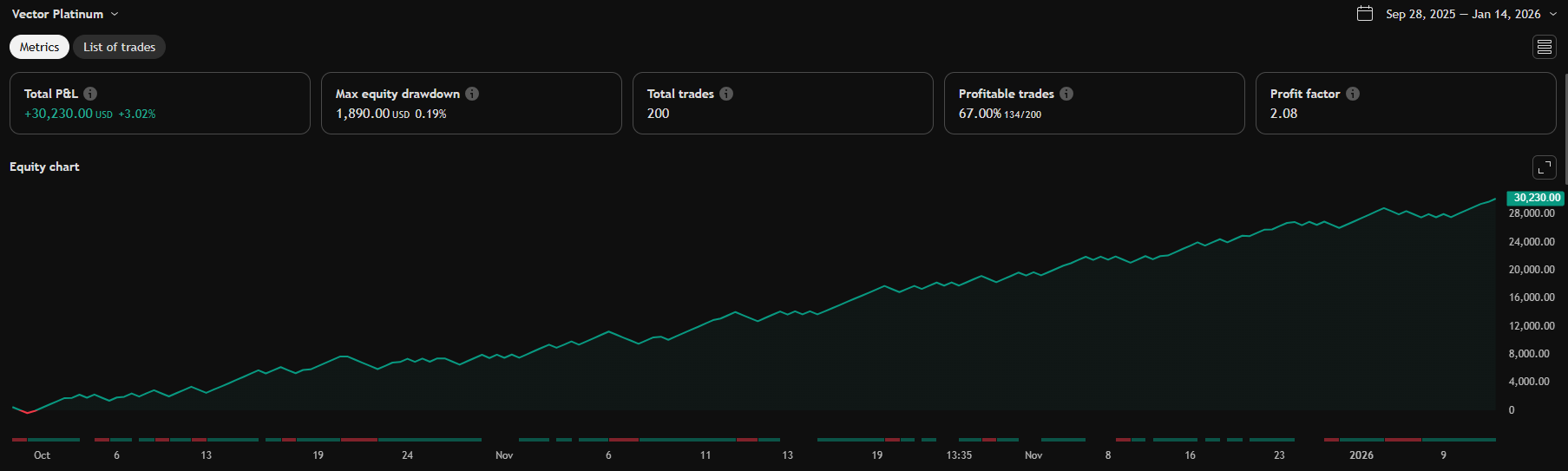

Unlike typical indicators that show pretty lines with no validation, Vector Platinum includes out-of-sample testing, overfitting detection, and prop firm drawdown protection—giving you confidence your edge works on unseen data, not just optimized backtests.

Whether you trade manually or automate via webhooks, Vector Platinum provides institutional-grade risk management, market regime filtering, and real-time performance analytics—all without writing a single line of code.

8 pullback triggers including Keltner, Bollinger Bands, Fibonacci, Fair Value Gaps, and Support/Resistance with 18 confluence indicators.

3 stop-loss modes, customizable R:R ratios, auto breakeven, time decay exits, and prop firm-style drawdown protection.

HTF trend alignment, market regime detection, volume confirmation, and session-based trading windows.

Webhook-ready JSON alerts for broker integration with configurable entry/exit templates.

Out-of-Sample validation with overfitting detection ensures your settings work on unseen data.

20+ live performance metrics, win/loss streak tracking, and P/L calendars directly on your chart.

Multi-confluence triggers validated in real market conditions

Full control over risk management, position sizing, and entry triggers

Stack multiple indicators for high-probability setups

Get instant access to Vector Platinum. No credit card required for your 7-day trial.

Choose your market, timeframe, and risk parameters through the streamlined settings panel.

Run Out-of-Sample testing to ensure your settings are robust, not overfitted.

Go live manually or automate with webhooks. Monitor performance with real-time analytics.

Per Month • Early-Bird Access

⚡ Early bird price locks forever—even as we expand our strategy suite